Delta Alerts: Percentage Price Change Alerts over Several Days

Most price alerts only tell you what happened today.

But meaningful market moves often unfold over several days or weeks.

With Delta Alerts by Wavealert, you can track percentage price changes over a custom time period — not just within a single trading day.

The problem with traditional price alerts

Classic alerts usually work like this:

- alert me when price hits X

- alert me when price changes by X% today

This creates two problems:

- Noise: short-term volatility triggers alerts that don’t matter

- Blind spots: slow but important trends go unnoticed

If an asset drops 8% over 14 days, a daily alert may never fire — even though the move is strategically relevant.

The solution: Delta Alerts with a custom time range

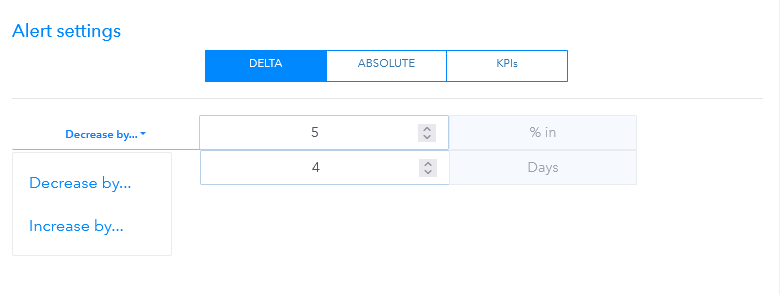

A Delta Alert monitors the percentage change of an asset over a period you define.

You decide:

- the percentage change (e.g. −5%, +10%)

- the time window (e.g. 3 days, 14 days, 30 days)

Wavealert then continuously evaluates the price movement and notifies you as soon as the defined delta is reached — regardless of how the move is distributed across days.

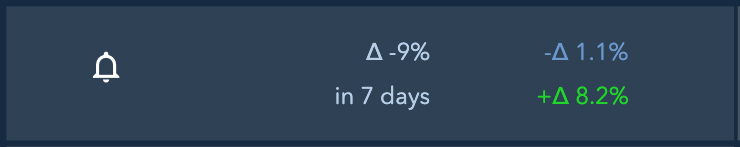

When an alert is triggered, the current negative delta and positive delta are always displayed. The negative delta shows the sharpest decline in the selected period (starting from the maximum) to date, and the positive delta shows the largest increase (starting from the minimum).

Daily Alerts vs. Delta Alerts

| Daily Alert | Delta Alert (Wavealert) | |

|---|---|---|

| Time period | Single trading day | Fully customizable (e.g. 3, 14, 30 days) |

| Evaluation | Daily price change | Cumulative price change |

| Typical signal | Short-term fluctuation | Meaningful trend movement |

| Risk | High noise level | Focus on relevant trends |

| Best suited for | Intraday monitoring | Strategic investing & portfolio tracking |

| Special feature | Standard in most tools | Unique Delta logic by Wavealert |

Example: Detecting real trend moves instead of daily noise

Scenario:

You are tracking a technology ETF and want to react if the market sentiment deteriorates meaningfully — not because of a single bad day.

Delta Alert setup:

- Time period: 14 days

- Threshold: −7%

Result:

Wavealert sends an alert as soon as the ETF has lost 7% over the last 14 days — even if no single day exceeded −2%.

This allows you to:

- react to real trend shifts

- avoid emotional decisions based on daily fluctuations

- apply rules consistently across assets

Why Delta Alerts are a powerful strategic tool

Delta Alerts help you move from reactive monitoring to rule-based investing:

- focus on meaningful price movements, not intraday noise

- apply the same logic to stocks, ETFs, crypto & precious metals

- detect slow trend reversals early

- automate strategies that would be impossible to track manually

They are especially useful for long-term investors, swing traders, and portfolio monitoring.

Combined with Asset Notes (Strategy Notes)

Every Delta Alert email automatically includes your Asset Note (Strategy Note):

- why you are watching the asset

- what action you planned

- what the alert means in your strategy

For Details see Notes** – store your action plan for each alert

Frequently asked questions about Delta Alerts

What is a Delta Alert?

A Delta Alert triggers when an asset’s price changes by a defined percentage over a custom time period (for example −5% over 10 days), not just within a single day.

How is this different from normal percentage alerts?

Most percentage alerts only look at daily changes. Delta Alerts evaluate the cumulative price movement across multiple days, which helps identify real trends instead of short-term volatility.

Which time periods can I use?

You can freely choose the time range — from a few days to multiple weeks. This allows you to adapt alerts to your personal strategy and investment horizon.

Can I use Delta Alerts for all asset types?

Yes. Delta Alerts work for stocks, ETFs, cryptocurrencies, and precious metals, as long as price data is available.

How do I get notified?

When a Delta Alert triggers, you receive an email notification including price data, relevant news, and your personal notes for that asset.

Perfect combinations with other features

- Portfolio Tracker – your entire asset list in one overview

- Stock Watchlist – monitor individual stocks efficiently

- ETFs & ETCs – track trend signals for funds

- Cryptocurrencies – manage highly volatile markets

- Gold & Silver – include physical holdings in your alerts

- Community Alerts – discover popular signals from other users

- News Analysis – understand the reasons behind price movements

- Asset Notes – store your action plan for each alert

- 200-day-moving-average – recognize long-term trends

Register for free and monitor assets with powerful alerts tailored to your strategy.

Learn more about our fair pricing model on the Pricing page.